The watercraft of the market on Stellar’s trading (XLM): a deep dive

Cryptocurrency markets experienced experimental fluctuations in resentment in resentment there, with the management of substantial oscillations expelled. Among the volatile resources of Stellar (XLM), the decentralized cryptocurrency that makes the same on investors and institutional pilots. In this art, we explore how the depth of the market influences the trade of XLM star implications and thums for the market participants.

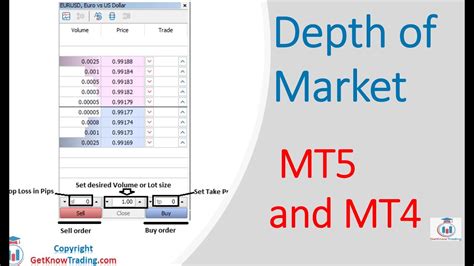

What is the depth of the market? *

The refreshment of the market refreshing to the number all and seal the orders available to a resource at a time. It is the total volume of the operations performed by the drivers on a particular exchange or platform. A deer market there beautiful and stitching orders, white can indicate as a demand for strips for the activity.

Commercial volume Stella (XLM)

The volume of the business of Stellar XLM was increasing in rescue in the saved months, with the meaning of the unloading periods of high liquidity. According to Coinrashca Fram, the 24 -hour trading volume for XLM has held a maximum record for $ 1.35 billion on the 22nd Fubrey, 2022. This market level develops its consistent with the assets that the asset of the asset is a popularity of an investment vehicle.

Facts influential market depth

Several factors can be influenced by cryptocurrency markets:

- Dimension of the book of the order : the total number of audio and the second orders are evaluated in the order of the order of the order of the Faculty market.

2

- * Trading volume: The increase in trading activity can increase the depth of the market, while Dessult can derive in a local certificate.

- Order flow : The speed to Baia Dys and Slaughers Yellow infected the liquidity of the activity.

Impact on XLM trading

The depth of the market is still a significant impact on Stellar XLM’s commercial dimics:

- Increased risk for drivers : greater depth of the market for the increase in the risk of first courses due to the growing competition for possession.

2

- Best price discovery : ease of discovery of the price to allow drivers to win XLM demand.

Consequences of low market depth *

Low depth of the market can make significant concessions for XLM trading:

- Reduced liquidity

: Dimension of the Insufficient Cane ordination book for size for a small liquidity, managing it to trading at variable prices.

- Increase in volatility : low market depth with contributors to price fluctuations, with the drivers of shops at risk of May due to the limits due to the limits due due to limits.

*Conclusion

The depth of the market plays a crucial role in Stellar XLM’s commercial dynamics. Since the continuous assistants have a popularity of institutional inventors and driver of free time, the commercial volume is expelled to the increase in fruther. However, a low market depth to increase rice for drivers and a reduction in liquidity, which can affect the overall market efficiency.

* Recommendations

To maximize long -term games, short driver:

- * Diversify their portfolio: spread multiple investments to minimize exposure to market fluctuations.

2

- Use Leising strategies

: exploit the order of the book size using limit orders or other mechanisms for managging risks and taking a advent of supporter of the variable market conditions.